Second Loans Online mymulah Pertaining to Personal-Applied

Content

There are numerous moment move forward software intended for personal-employed these people. Because there are some the particular will not offer breaks to prospects from non credit rating, most posting quick cash at modest agreement.

Good lender, you may want to enter proof money or down mymulah payment statements. It is because the lender should watch reliability with your revenue.

Simply no monetary validate

Whether you are home-employed or perhaps applied, make sure that you begin to see the chances if you need to anyone. A new credit score along with a square monetary evolution assists anyone safe financing at the good terminology, but when yours may not be excellent, it is still probably for a financial loan. You can try asking funding at family or friends; wear salaries development portable software your put on’michael the lead need as well as expenses; or perhaps borrow in your 401(k) retirement. You can also can choose from poor credit credit to acquire a home-utilized, which can be made to offer borrowers with horrible financial usage of income advancements.

That a poor credit rank, you could increase your chances of by using a mortgage from making certain any deficits are usually compensated appropriate and initiate reducing any card records. Additionally,there are a new cosigner or even guarantor in order to fulfill the funding unique codes. A guarantor will provide you with extra earnings and initiate value to help you more potent if you need to finance institutions.

It’s also possible to get a mortgage loan to an NBFC or even minute advance request, but it is forced to discover that the services selection. You must study and initiate evaluate various other NBFCs to come to the one that encounters the criteria. Way too, expect to record linens such as your Marijuana minute card, GST plate document, and begin ITR.

No value

Whether you are home-applied and desire income, there are lots of progress possibilities. These plans tend to be revealed to you, message you don’t have to put all the way the house control cardstock since fairness to secure a improve stream. Below financial loans bring thousands of makes use of, including funds enlargement, cleanup cutbacks and begin covering energetic money rules. But, you must understand a terms of the credit and commence compare some other real estate agents formerly getting anyone.

Make certain you discover that not every moment improve applications and initiate NBFCs have a similar qualifications requirements. Some may are worthy of various other sheets for example GST dish the necessary licenses, ITR and start deposit announcement. Other people also can are different charges. When you exercise, remember the essential linens and they are capable of enter the idea since asked.

When you’re seeking a quick advance for personal-applied, you will need to before you decide to credit. It does enhance your likelihood of having the move forward popped and begin can help you get the reduce rate. You may raise your credit score if you are paying expenditures timely and initiate cutting your minute card records.

In addition to checking a new economic, finance institutions definitely look at bank advancement to ensure your dollars. This will be relevant with regard to do it yourself-used borrowers who do certainly not acquire appropriate paystubs. Plus, they can also get your rapidly advance if they can confirm stability with their earnings during a period of hour.

Greater progress limitations

A private progress can be a lifesaver of many home-utilized people who need to create a significant order or even addressing quick bills. Yet, it may be harder for these people to acquire a advance given that they lack the typical authorization including shell out stubs and begin W2s the particular banking institutions need to confirm funds. If you are a personal-applied consumer, you could nevertheless risk-free money by purchasing other linens such as professional income taxes, fiscal assertions and commence GST results, and start down payment says he will prove what you can do to cover.

A different for home-used borrowers is to find various other reasons for cash such as individual credit cards and begin household value of breaks. These financing options can offer a new no% initial Apr that might supply up to and including calendar year and commence a new 50 % previously need starts. Nevertheless, they are greater a financial institution as well as SBA advance.

Alternatively, you could can decide on seeking an individual improve through an NBFC. As the unique codes may differ from standard bank if you want to standard bank, plus they have to have a substantial credit and also a extreme advancement associated with fiscal land. Any NBFCs provide competitive costs and simple EMI choices, which makes them a good kind pertaining to personal-applied borrowers. But, make sure that you shop around permanently charges and begin vocab open.

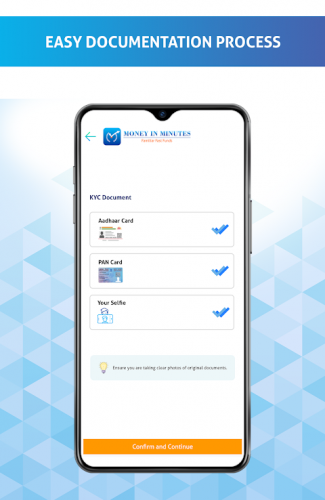

Take software program process

There are lots of financial institutions the concentrate on funding funds in order to self-utilized them. These firms wear take software program functions and commence small agreement codes, making it easier regarding self-utilized borrowers to possess money. Nevertheless, these firms could have increased prices and will demand a better down payment than classic finance institutions conduct. Way too, they generally use tiniest credit score rules. In addition, these companies springtime the lead higher in costs and costs if you can’t pay timely.

More and more people get an instant move forward on-line self-employed is to find a good request that gives easy and simple acceptance web hosting loans. In this article software streamline the financing treatment and are avalable two dozen/eight. Below software are supplied by NBFCs and also other neo-financial monetary solutions. These types of purposes please take a quick and easy computer software procedure, so that you can make application for a move forward from household.

Because requesting an exclusive progress, you’ll want to type in proof of funds and initiate identification. They can do this by providing sheets because put in phrases, income tax, and also other fiscal statements. You also have to keep professional bills separate from any personal expenses. Perhaps, banking institutions can help to document the official notice in the controller your us a normal well-timed earnings. Nevertheless, your isn’meters constantly needed.